Flexibility and automotive after sales

Among the macrotrends that guide the automotive industry on the path of change, urbanization is one of the factors driving the adoption of advanced mobility models.

According to the UN’s World Urbanization Prospects report, in 2018 55% of the population lived in metropolitan contexts, with an estimated growth to 68% by 2050.

This implies, in addition to the technological push, changes in the paradigms of consumption and in the ways in which people move. To keep a market presence (physical or virtual) and intercept renewed customer needs, automakers will have to change the structure of their networks.

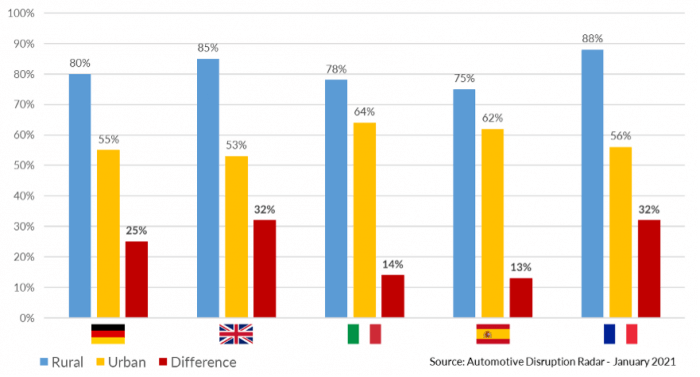

However, beyond the long-term projections, a deeper analysis shows that there is room for complementary distribution models, aimed at the portion of the population living outside the large urban contexts and that uses the car proportionally more and with higher frequency.

The lack of infrastructure (public transport, “smart” mobility …) and the conformation of extra-urban areas, where services are distributed over a large territory, cause a more intense use of private vehicles, as illustrated in the following graphic:

In the near future, the evolution in the sales area will allow the purchase phases to be managed effectively, the tools provided by technology make physical commercial structures less necessary than in the past. In Europe, for example, online car sales could reach 8% in 2025 and up to 40% in 2035 (Projected Growth in Online Sales of New Cars Around the World – BCG 2020).

For the service, the theme has other nuances, since physical presence continues to be, and will be, an essential requirement. In addition to considerations about the use of vehicles, in rural areas there is a longer age of the car park – also linked to softer environmental regulations for driving outside the metropolis – which implies a higher need for assistance.

There is room for growth for a business that, although in an evolved key, sees the physical workshop as a determining factor for loyalty and the completion of the customer experience. Organizations able to combine technology, breadth of services – “one-stop shop”, including alternative mobility – and proximity to the client, will find a considerable margin of growth and will benefit from a smoother transition towards new technological paradigms.

Therefore, for the automotive actors there is the need to adopt flexible strategies and processes, in which the standards are set by the customer, whose decision-making power exceeds the methods that have characterized the industry for decades.

In particular, truly collaborative development models that reinforce the manufacturer-dealer partnership will succeed in providing adequate responses to a variety of demands and ensuring continuity over time.

We have embarked with MAN Truck & Bus SE on a journey towards Excellence. The MAN Trucks Kraków plant, one of the… Read more

The ecological transition is in the focus of the debate on the sector of the automobile. At the same time, we all realize… Read more

The coronavirus is inducing unpredicted effects and leading to a critical review of how the society will be, for setting the… Read more